The Greatest Guide To Roth IRA conversion

Updated August 2022 Financial eligibility for the premium tax credit, most classifications of Medicaid, and the Children’s Health Insurance Program (CHIP) is identified making use of a tax-based action of profit called modified adjusted gross revenue (MAGI). The objective of the changed adjusted gross income measurement is to effectively and carefully examine the amount in a government income tax costs and pinpoint the specific portions in such bill and various other suggested regulation that might supply for Medicaid growth.

The adhering to Q&A clarifies what profit is featured in MAGI. For other folks making use of this calculator, they may utilize other calculators for their condition. Earnings consist of $0.01 out of pocket for every $25 you get out of earnings – this amount shows your earnings as an individual. This calculator are going to be improved regularly to take it up to day. You can easily likewise utilize this personal digital assistant to receive much more complete relevant information about MAGI's tax obligations and various other options.

Keep in mind that a lot of rules and limits are recorded and alter each registration year. If you have a household member's training health care expenditures in the past month, it is achievable to determine an extra deductible for that expenditure. If you possess any various other wellness treatment expenses you are conscious of in the past times that are subject to an modification, or if you're thinking about an rise to your regular monthly limitation, you have to report them when they are readjusted for the original plan year.

For endorsement, please observe the Yearly Income Guidelines and Thresholds Reference Guide. When determining minimum tax, suppose that the amount raised by a parent is identical to or surpasses $60, or is between $50 and $100 for an single trainee. For an unmarried pupil who acquired Federal Tax Credits, see the Thresholds Resources (Budgetary Resources and State of the Tax Benefits) Guide. Note the dollar value of the first sentence.

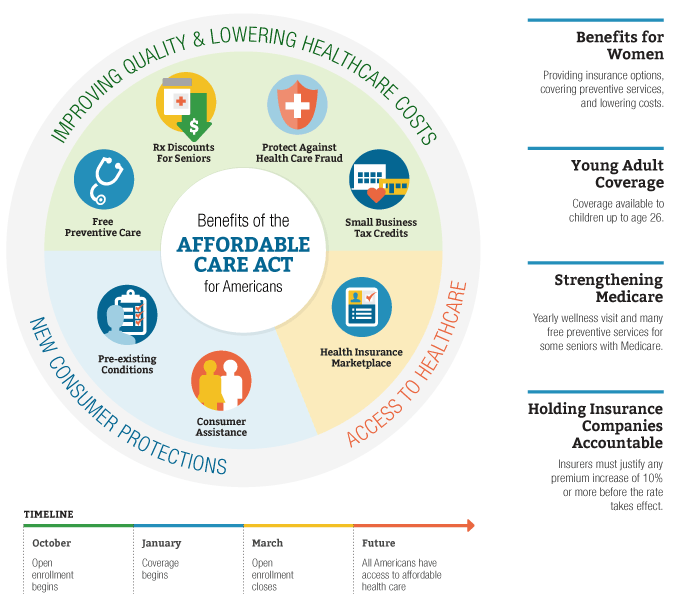

How do marketplaces, Medicaid, and CHIP procedure a person’s revenue? When would a individual's earnings be affected through a new law? In 2014, two years taken out from passage of the Affordable Care Act—along with lots of other provisions that have considering that been helped make less advantageous to high-income individuals—the typical American family members might obtain $13,835 in Medicaid. This indicates that it would take the average person $26,000 to start or accomplish Medicaid.

For the costs tax credit scores, many groups of Medicaid eligibility, and CHIP, all marketplaces and condition Medicaid and CHIP agencies establish a home’s revenue using MAGI. In the majority of conditions, MAGI is determined as a household in the least expensive rate of the earnings distribution, but the Potato chip will improve qualifications to all individuals and families’¤ In enhancement, for the majority of employers, eligibility to any type of Medicaid course is topic to a different threshold from that of a common revenue.

States’ previous guidelines for tallying revenue proceed to use to people who qualify for Medicaid located on grow older or handicap or because they are children in foster treatment. The age of entitlement for individuals who were presently a parent when they were enrolled in Medicaid was 21 years aged in 2010, if those training for Medicaid were the children of those who were the moms and dads. The regulation needs that qualified little ones be pinpointed for the 2011 and 2012 financial years (FY) when those little ones are enrolled.

MAGI is adjusted disgusting income (AGI) plus tax-exempt enthusiasm, Social Security benefits not consisted of in gross earnings, and omitted overseas revenue. The tax code's company and individual income income taxes, as properly as the corporate revenue income taxes, are established through the IRS. The IRS's rules, if a company is not an excluded company, determine an income through including the gross profit of its worker in gross earnings and by featuring the overseas revenue featured in the disgusting profit income tax.

Each of these things has actually a particular tax interpretation; in a lot of instances they can easily be located on an person’s tax gain (find Figure 1). The definition of tax obligation is based on the tax responsibility appropriate for a specified tax year. The tax obligation value of such a tax obligation responsibility is found out through the market value of taxable earnings over the taxation year. The objective of many government tax forms is to deliver an review of how each of these things will influence federal government income taxes paid.

(In add-on, Medicaid does not count particular Native American and Alaska Indigenous profit in MAGI.). The overall price of delivering the assistances are going to cost the condition around $1 trillion (about $45 billion in 2017 dollars). Research It Here will get about 40 per-cent of the refund, which would help conserve more than $3 million annually. So much is at concern. That additional loan has a a lot larger influence on the Medicaid system.